Form W-3 is a vital document prepared by employers. To explain further for understanding, think of IRS tax form W-3 as a report card summarizing wages, tips, and other compensation, as Social Security and Medicare taxes paid to employees in one fiscal year. It is linked with W-2 forms and mirrors the information contained therein. After completing it, the employer sends it directly to the Social Security Administration (SSA), not to the individual workers.

Now, to make this process less daunting, resources like w3taxform.net have been created. Our website is a valuable hub for taxpayers, providing access to a blank W3 form for 2022 and earlier years. In addition to this, detailed W3 tax form instructions can be found there. If I may use an analogy, it's much like a bakery that not only gives you fresh bread but also hands out the recipe. The instructions presented, alongside varying examples, simplify the task of form filling, helping employers accurately and confidently complete their W-3 copies.

The Tax Form W-3 Functionality and Connection to the W-2 Return

If you manage or own a business that employs individuals, it's important to understand your tax obligations. Among these obligations is the need to file the federal tax form W-3. Consider this form similar to a cover page for all W-2s you provide to the Internal Revenue Service (IRS).

Let's consider who needs to fill out this document. You are required to submit a W3 tax form for 2022 if you paid wages to employees and withheld income, Social Security, or Medicare taxes. Now, let's take a look at specific situations where you may be exempt from filing the form:

- Businesses that solely contract with independent entities are not required to file.

- You're also exempt from filing the IRS W-3 transmittal form if you run a church-operated tax-exempt school.

- Agricultural employers who pay wages to seasonal and temporary workers, principally in kind rather than in cash, are exempt from filing this report.

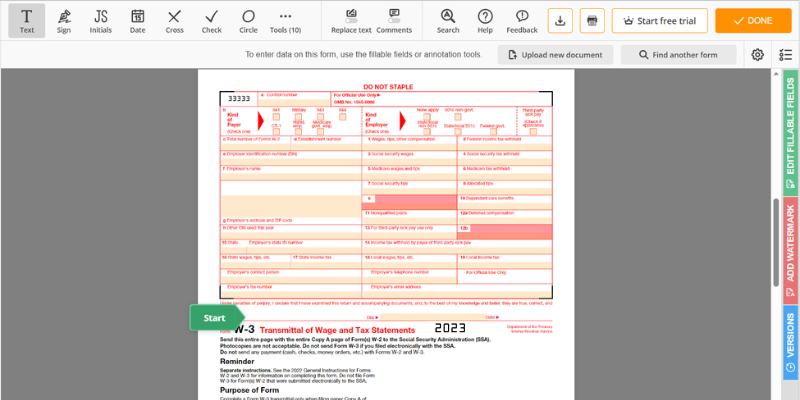

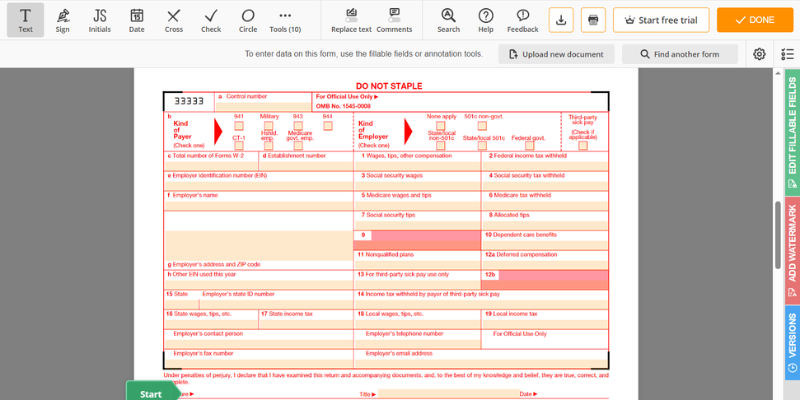

Instructions to Fill Out IRS Form W3 in 2023

This step-by-step guide will facilitate the completion of Form W-3 in a correct and error-free manner.

- To kick off this process, navigate through this website to locate the official IRS W3 form in PDF format.

- Once found, ensure to review all the relevant sections designed to carry specific details. For instance, think of Section A as a box where you input your name.

- After reviewing, it's time to print the W3 tax form. On the website, you'll find a 'Print' button often represented as a printer icon. Click on this button and follow any subsequent prompts.

- Filling out the form, ensure to pen in the correct data; as they say, accuracy is the difference between making a missile and a boomerang!

- Once filled appropriately, review your details. If they check out, proceed to the 'Submit' button.

Armed with the printable W3 tax form for 2022 from our website, you're set to complete this document confidently. As a general note, remember this document serves as a summary of wages and tax statements. Hence, you're encouraged to handle it with maximum accuracy.

Due Date to File IRS Tax Form W-3

To ensure the smooth functioning of our tax system, our government has set specific deadlines for filing annual returns. One such is tax form W-3 for 2022, which the Internal Revenue Service (IRS) requires to be submitted by the last day of January following the fiscal year.

This date has been chosen to allow for the reconciliation of all W-2 forms, which are generally sent out by employers in January. The W-3 acts as a summary of these forms; thus, the due date is positioned to give taxpayers ample time to collect, review, and document all necessary information.

However, if circumstances prevent you from submitting the W3 tax form to the IRS on time, you can apply for a time extension. If approved, this extension allows you to submit the report at a later date, typically providing an extra six months. Nevertheless, it's better to file as early as possible to avoid potential penalties.

Fillable Form W-3 - Instructions for 2023

Fillable Form W-3 - Instructions for 2023

IRS W3 Form (2022)

IRS W3 Form (2022)

Federal Form W-3 & W-2

Federal Form W-3 & W-2

Printable Form W-3

Printable Form W-3

Free W3 Fillable Form

Free W3 Fillable Form